Two weeks ago, Pipitone Group had the opportunity to sponsor “Dodge Construction Outlook 2020” and attend a series of workshops and informational sessions and listen to several impressive keynote speakers.

First, the Outlook

The U.S. Economy and construction market have reached a tipping point. After a solid 10-year economic expansion and moderately healthy recovery in construction, total construction starts are now tipping over the edge into decline. According to Dodge Data & Analytics, total starts reached a peak of $815 billion in 2018 and will inch down 1% to $809 billion in 2019. With a potential economic storm (or at least some rain) gathering on the horizon, total construction starts are expected to decline another 4% in 2020 to $776 billion. While these are composite numbers, some segments and regions of the country vary in their individual performance. Also, certain product and service categories may be impacted differently.

Wednesday’s Workshops

Wednesday’s Workshops

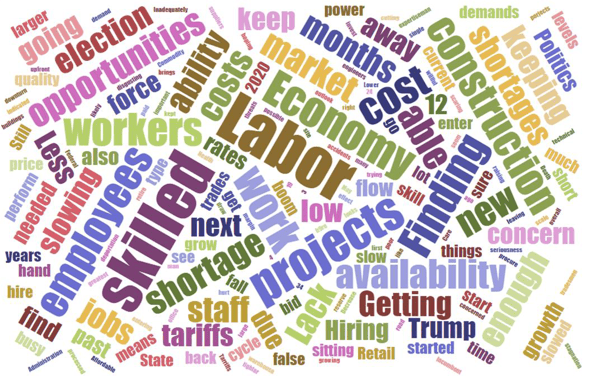

While newly appointed Richard Branch, chief economist for Dodge Data & Analytics provided a preview of the Construction Outlook, he also provided a word cloud visualizing the biggest challenges in the next 12 months. It was no surprise to anyone that finding skilled labor was at the top of the list. He also highlighted:

Positives

- Healthy job growth/consumer spending

- Low interest rates (easing cycle)

- Two-year budget deal signed in early-August/debt ceiling lifted

Negatives

- Trade tensions

- Lack of skilled/available labor

- Weaker global growth

- Worsening budget deficit

- Election/politics

Top Trends

Steve Jones, senior director, Industry Insights Research with Dodge, provided an in-depth presentation surrounding 10 Trends Impacting the Construction Industry, Integrated Digital Workflows and the Contractors’ Use of Digital Resources for Building Products/Materials. While the first two topics were of interest, as an integrated marketer, I had a special interest in the Contractors Use of Digital Resources. In his presentation, Jones noted:

- Contractors are using online sources to research building products and materials. They look for comprehensive selection and dislike out-of-date information

- 70 percent of contractors read online reviews and are influenced by them

- 51 percent of contractors use social media for information about building products and materials. They most frequently use YouTube and LinkedIn. Videos and reports are the most sought-after content types.

Next week, we’ll share insights from the keynote speakers. Stay tuned!